STEAM Token

The STEAM token is the governance and utility backbone of the Zhenglong ecosystem. While it's not directly involved in minting or redeeming zheTOKENS and steamedTOKENS, it plays a crucial role in shaping the future of the protocol - and in rewarding those who support it.

Holding STEAM isn't just about passive speculation. It's about owning a stake in Zhenglong's growth, security, and direction.

1. Governance Rights

STEAM holders have voting power over how Zhenglong evolves. Community members can propose or vote on:

- New markets to launch

- Fee or collateral ratio adjustments

- Protocol upgrades

To participate in governance, you lock up your STEAM tokens in a voting escrow system (called veSTEAM, similar to Curve's veCRV model). The longer you lock, the more influence you gain - and the more rewards you earn.

This setup rewards long-term thinking community members.

2. Revenue Sharing

Zhenglong generates revenue from several sources:

- Minting and redemption fees

- A portion of the yield earned by collateral

By converting STEAM to veSTEAM, you become eligible for a share of this revenue. Distribution methods can vary:

- Direct rebates

- Periodic payouts

- Buy-and-burn strategies

In short: if the system grows and generates more fees, STEAM holders benefit, making them directly aligned with the protocol's success.

3. Yield Boosts and Incentive Rewards

STEAM also plays a major role in rewarding active contributors:

- Genesis Vault participants and Stability Pool depositors earn STEAM.

- Liquidity providers (LPs) supplying zheTOKENS or steamedTOKENS to AMMs can also earn STEAM incentives.

But that's not all - holding and locking STEAM boosts your rewards:

- The more STEAM you lock, the higher your returns in Stability Pools or liquidity mining programs.

- This model encourages holders to stay engaged, rather than just dump tokens on the market.

This approach, inspired by DeFi pioneers like Curve and Convex, helps foster a committed and incentivized community - one that grows with the protocol, not apart from it.

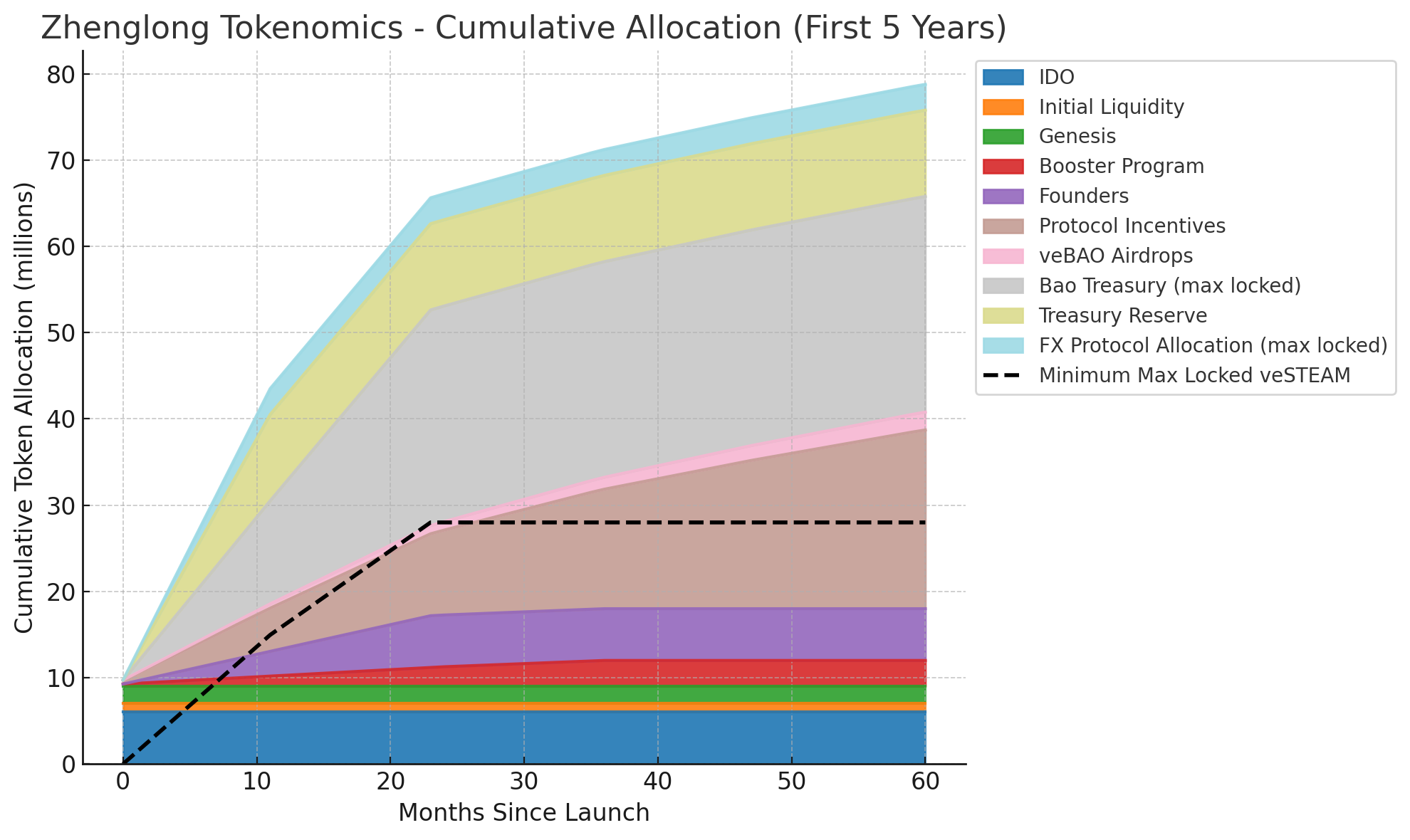

STEAM Tokenomics

Zhenglong is built to reward long-term participation, decentralize governance, and create sustainable liquidity incentives. All token allocations are transparently structured and time-released.

Total Supply: 100,000,000 $STEAM

| Category | Allocation | Vesting / Notes |

|---|---|---|

| 🏦 Bao Treasury | 25% | Vested linearly over 24 months. Max locked as veSTEAM. |

| 📦 Treasury Reserve | 10% | Vested linearly over 12 months. Protocol-controlled. |

| 🤝 FX Protocol Allocation | 3% | Vested linearly over 12 months. Max locked as veSTEAM. |

| 🚀 IDO | 6% | Fully liquid at TGE, distributed via community + public rounds. |

| 💧 Initial Liquidity | 1% | Deployed immediately on launch. |

| 🌱 Genesis Contributors | 2% | Rewards for initial liquidity providers. |

| 📣 Booster Program | 3% | Distributed over 3 years (0.27% TGE, 1% Y1, 1% Y2, 0.73% Y3). |

| 🧑💻 Founders | 6% | Vested linearly over 24 months. |

| 🌊 Protocol Incentives | 39% | 5M tokens distributed linearly in Year 1, then decaying 12.9% per year after. ~50-year runway. |

| 🎁 veBAO Airdrops | 5% | 500k tokens in Year 1, decreasing 10% annually. Fully distributed over 50+ years. |

🔒 Locked Governance Supply

The Bao Treasury and FX Protocol Allocation are both committed to permanent max lock as veSTEAM once vested.

These make up a minimum of 28% of the token supply that is guaranteed to be locked and actively contributing to protocol governance and emission direction.

On the chart, this is shown as an overlay line labeled:

🟢 Minimum locked as veSTEAM (Bao + FX Protocol)

📉 Emissions Logic

Protocol Incentives (39%)

- Year 1: 5,000,000 tokens emitted linearly

- Following years: each emits 12.9% less than the year before

- Modeled after Curve's emissions: decaying emissions with a long tail

- Emission lifespan: ~50+ years

veBAO Airdrops (5%)

- Year 1: 500,000 tokens (linear)

- Each subsequent year emits 10% less than the year before

- Also spans ~50+ years

- Designed to reward long-term aligned governance holders

📊 STEAM 5 Year Emissions

This chart shows:

- 📦 Cumulative token release over the first 5 years

- 🟩 Stacked areas for each allocation category

- 🔒 An overlay line for the minimum number of max-locked veSTEAM tokens from the Bao and FX Protocol allocations

The categories with immediate or early liquidity — IDO, Initial Liquidity, and Genesis — appear at the base for clarity.

All values are linear unless stated otherwise. No cliffs. No surprise unlocks.